Test prep, the ubiquitous thread in the lives of school students in India, is in a flux with changes in the country's examination system. Exploring the impact of these reforms on the Engineering/Medical test prep sector and a new business model that could possibly emerge.

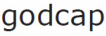

There are three categories of test prep providers:

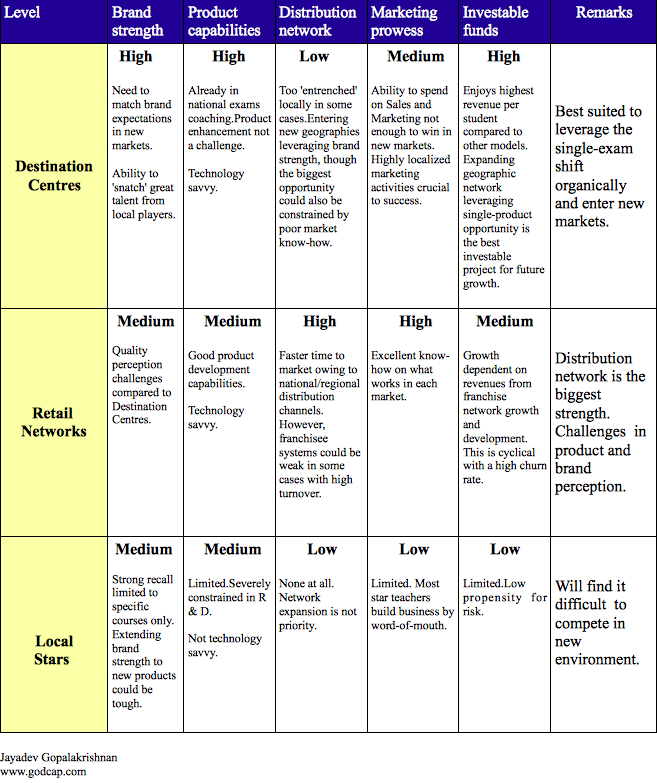

Destination centres: large-format players primarily focused on national exams like the IIT JEE, AIEEE (now JEE-Main) and the AIPMT. They have a few, but large centres working out of their own premises or in association with schools and colleges through an independent / integrated model. Brands: FIIT-JEE, Resonance, Bansal Classes.

Retail networks: multi-centre players focused on regional exams like the state Entrance exams and in some cases, national exams as well. They have either large regional networks (in a State or a particular geography) or national networks with centres across the country - either direct or franchisees. Brands: TIME, Career Launcher, Pearson Learning Centre.

Local stars: individual tutors/small tutorials primarily focused on regional exams(Board/Entrance) and in rare cases, national exams. They work out of homes or offices depending upon the size of the business.

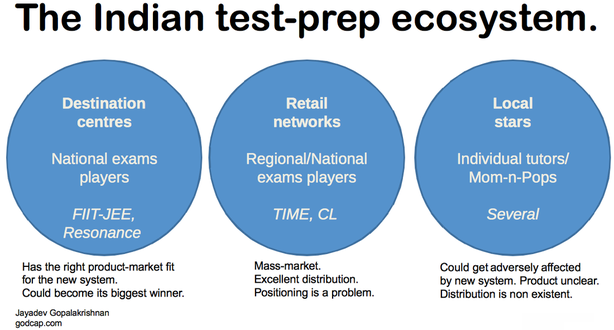

Together, these stakeholders constitute the USD 7 Bn dollar supplemental education sector in India in a USD 40 Bn market (CLSA 2009 figures). [For comparison, the US supplemental education market is worth USD 5 Bn.]

Destination centres: large-format players primarily focused on national exams like the IIT JEE, AIEEE (now JEE-Main) and the AIPMT. They have a few, but large centres working out of their own premises or in association with schools and colleges through an independent / integrated model. Brands: FIIT-JEE, Resonance, Bansal Classes.

Retail networks: multi-centre players focused on regional exams like the state Entrance exams and in some cases, national exams as well. They have either large regional networks (in a State or a particular geography) or national networks with centres across the country - either direct or franchisees. Brands: TIME, Career Launcher, Pearson Learning Centre.

Local stars: individual tutors/small tutorials primarily focused on regional exams(Board/Entrance) and in rare cases, national exams. They work out of homes or offices depending upon the size of the business.

Together, these stakeholders constitute the USD 7 Bn dollar supplemental education sector in India in a USD 40 Bn market (CLSA 2009 figures). [For comparison, the US supplemental education market is worth USD 5 Bn.]

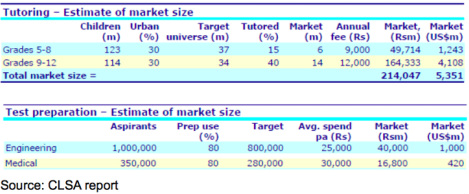

Using publicly available data and a rough estimate, the total organized segment is worth around USD 650 Mn or 10% of the total test prep market.

Rounding off to USD 1 Bn, that's just 15% of the market.

Rounding off to USD 1 Bn, that's just 15% of the market.

The unorganized players - Local stars - constituting 85% of the market, is bound to get most impacted by the impending changes in the examination system.

Everything is changing.

There are three important trends in the Indian test prep space:

Exams going online - Entrance exams having been pen-and-paper for decades, tutors shunned technology, cyclostyling was the norm and computers were only an after-thought. The online move by AIEEE, which used to be the single largest entrance exam in the country with over 1.1 million candidates, sent out a strong signal of the times to come.

Exams going national - For decades, exams have been disaggregated across states requiring students to prepare for different tests with different syllabi. The costs/logistics associated with this process was manifold and stressful for both parents and students alike. This is the reason local coaching providers exist and national players adapt products to each state exam. But now, entry into IIT, NITs and other national institutions is regulated by one exam - the JEE(Main). [NEET, the equivalent for medical seats is awaiting a court decision].

[Update: The NEET has been replaced by the AIPMT from 2014].

Renewed importance of Board exams and the move to a common syllabus - Students went through the 'factory model' to prepare for the IIT-JEE/other Entrance exams ignoring the 'Boards'. The result? High ranks in the Entrance exams and poor performance in Board exams. But this has changed now. Entry to IITs, NITs and other institutions using the new JEE (Main) system also takes Board exam marks into consideration. Also, heterogenous syllabi at the Board level had created unequal testing grounds and widened the gap between the Board and Entrance exams preparation making coaching a mandatory requirement for success. Science and Math syllabi at the senior secondary level (Board exams) has now been standardized making it a level-playing field.

Though it's going to be a while before all state exams are brought under a common test and the NEET issue (equivalent for single exam for medicine) gets resolved amicably [Update: NEET has been replaced by AIPMT from 2014], the writing on the wall is towards a homogenous examination system.

What does this imply?

Under these new circumstances, the biggest winners are Destination centres. Having operated at the national exams level, this is a network expansion game for them (to Tier 2/Tier 3 towns) and a never-before opportunity to scale up using the same or an enhanced product mix. Their entry will have a significant impact on the business currently enjoyed by Retail and Local institutions.

On the other hand, Retail networks can make the most of this opportunity from a distribution perspective. With well-entrenched channels in place, they have to focus on ramping up product development capabilities and introducing new courses across centres. However, they will find themselves in constant battle against against the invasion by larger Destination brands that have a much stronger brand-pull and high-profile faculty. Franchisees of these Retail networks could also get severely affected as most Destination centres tend to set up direct centres in new towns.

There would be significant level of consolidation in this segment with Destination centres acquiring regional/national Retail networks for giving them immediate access and reach.

Everything is changing.

There are three important trends in the Indian test prep space:

Exams going online - Entrance exams having been pen-and-paper for decades, tutors shunned technology, cyclostyling was the norm and computers were only an after-thought. The online move by AIEEE, which used to be the single largest entrance exam in the country with over 1.1 million candidates, sent out a strong signal of the times to come.

Exams going national - For decades, exams have been disaggregated across states requiring students to prepare for different tests with different syllabi. The costs/logistics associated with this process was manifold and stressful for both parents and students alike. This is the reason local coaching providers exist and national players adapt products to each state exam. But now, entry into IIT, NITs and other national institutions is regulated by one exam - the JEE(Main). [NEET, the equivalent for medical seats is awaiting a court decision].

[Update: The NEET has been replaced by the AIPMT from 2014].

Renewed importance of Board exams and the move to a common syllabus - Students went through the 'factory model' to prepare for the IIT-JEE/other Entrance exams ignoring the 'Boards'. The result? High ranks in the Entrance exams and poor performance in Board exams. But this has changed now. Entry to IITs, NITs and other institutions using the new JEE (Main) system also takes Board exam marks into consideration. Also, heterogenous syllabi at the Board level had created unequal testing grounds and widened the gap between the Board and Entrance exams preparation making coaching a mandatory requirement for success. Science and Math syllabi at the senior secondary level (Board exams) has now been standardized making it a level-playing field.

Though it's going to be a while before all state exams are brought under a common test and the NEET issue (equivalent for single exam for medicine) gets resolved amicably [Update: NEET has been replaced by AIPMT from 2014], the writing on the wall is towards a homogenous examination system.

What does this imply?

Under these new circumstances, the biggest winners are Destination centres. Having operated at the national exams level, this is a network expansion game for them (to Tier 2/Tier 3 towns) and a never-before opportunity to scale up using the same or an enhanced product mix. Their entry will have a significant impact on the business currently enjoyed by Retail and Local institutions.

On the other hand, Retail networks can make the most of this opportunity from a distribution perspective. With well-entrenched channels in place, they have to focus on ramping up product development capabilities and introducing new courses across centres. However, they will find themselves in constant battle against against the invasion by larger Destination brands that have a much stronger brand-pull and high-profile faculty. Franchisees of these Retail networks could also get severely affected as most Destination centres tend to set up direct centres in new towns.

There would be significant level of consolidation in this segment with Destination centres acquiring regional/national Retail networks for giving them immediate access and reach.

But the ones challenged most in terms of both product and distribution are the Local stars. They need help in riding changes happening in the examination system driven by technology and regulation shifts. Whereas the organized segment has access to in-house technology resources and human capital who can help leverage this situation to their advantage, the smaller players have no support/infrastructure whatsoever to make this transition successfully.

The USD 6 Bn opportunity in the Local stars space:

There is a clear opportunity to 'organize' the Local stars market. They have excellent market know-how, great local credibility and fantastic entrepreneurial drive. But they do not have product development capabilities, a strong marketing engine and the technology know-how, making this an attractive business case.

--

"Shastri Tutorials (ST) is a 10-year old brand in the 9th – 12th coaching segment. Prof.Ravi Shastri who started the company is a veteran in the coaching field and a well-known Physics teacher. What started as a 1000-students per year entity has now fallen to less than half the size due to increasing competition from breakaway outfits and the entry of organized players vying for the same segment. Prof.Shastri is comfortable with the current level of business, but understands change is critical to survival in the coming years. He knows what needs to be done: a general makeover - new products combining Board and Entrance tests, faculty trained on current exam trends, up-to-date material, better branding, use of digital tools that students are accustomed to these days, value additions such as network-based ranking, SMS+E-mail alerts, etc. But he also realizes that this involves a lot of money. Moreover, at 56, he lacks the know-how and capabilities to move in a whole new direction. There have been offers from the past to merge with fellow tutorials in the city, but then, he did not want to let go of a business he had so carefully nurtured over the years."

'Acme Learning' sees a clear opportunity in creating an umbrella brand and unifying these smaller players while helping them move to Ver 2.0. Their goal is to create a pan-India network bringing smaller players and mom-and-pops under the 'Acme Learning Network'.

Acme Learning Network offers the promise of a big brand combined with the trustworthiness of a local player. 'Shastri Tutorials' will now become 'Shasti Tutorials - A Acme Learning Network member'.

--

What will Prof.Shastri expect to gain from Acme in exchange for a small percentage of its revenues?

- Centralized product development.

Product know-how, high-quality study materials and tests in sync with the latest exam requirements that helps them compete with the larger players.

- Lower marketing/acquisition costs.

The power of a common brand signals uniform standards of quality to the market. Common pan-India marketing events aimed at brand-building and common admission drives lowering the average cost of acquisition for the members. Expensive media buys negotiated in bulk and common advertisements released bringing in huge cost savings. Exam Results ads and promotions leveraging the combined strength of the network.

- Regular teacher training.

New pedagogy and techniques. Improving teacher hiring practices. Remedial sessions over the internet. Certification systems. Reinforcement programmes. Intervention by top faculty members for specialized subjects/topics over VSAT/terrestrial internet.

- Up-to-date technology and support.

Right from centre management to student/parent communication systems and MIS. Online testing platforms. Mobile and Tablet apps integrated with course offerings. Centralized ranking for exams across the entire network (a huge plus for students in small towns). Digital classrooms.

In a single move, Shastri Tutorials gets a full makeover in terms of Brand, Product, Technology, Reach, Visibility, and Faculty. And Acme benefits from the entrepreneurial energy and experience of an existent, large tutor base. A win-win for both parties.

These are, but a few of the benefits that this model offers - the power of a large brand in terms of product, network and marketing; and at the same time the continued autonomy of managing a small business - a model of empowerment rather than that of a franchise. In a franchising system, the franchisor 'appoints' a potential partner - a teacher or in most cases, an entrepreneur looking for new opportunities - the churn rate is huge as there are capabilities mismatch or loss of interest in driving business. Customers are wary sometimes in joining franchisees (though many end up performing even better than company centres).

However, in the aforesaid model, the franchisor plays the part of an enabler who co-opts existing tutors/smaller players already operating in the space, consolidating them under one network and providing them resources that are crucial to their sustained success in a new market. In the eyes of the local market, this is the same Prof.Shastri who they have trusted all along offering a better product and service in a new avatar. He is not a stranger.

By building an organic network based on 85% of the test-prep market, a new 1000+ centres across India under a common brand looks like the big opportunity that could spurn the next wave of innovation and growth in a space, otherwise saturated by staid business models.

It's time to re-invent the test prep industry with the help of the neighbourhood tuition master.

The USD 6 Bn opportunity in the Local stars space:

There is a clear opportunity to 'organize' the Local stars market. They have excellent market know-how, great local credibility and fantastic entrepreneurial drive. But they do not have product development capabilities, a strong marketing engine and the technology know-how, making this an attractive business case.

--

"Shastri Tutorials (ST) is a 10-year old brand in the 9th – 12th coaching segment. Prof.Ravi Shastri who started the company is a veteran in the coaching field and a well-known Physics teacher. What started as a 1000-students per year entity has now fallen to less than half the size due to increasing competition from breakaway outfits and the entry of organized players vying for the same segment. Prof.Shastri is comfortable with the current level of business, but understands change is critical to survival in the coming years. He knows what needs to be done: a general makeover - new products combining Board and Entrance tests, faculty trained on current exam trends, up-to-date material, better branding, use of digital tools that students are accustomed to these days, value additions such as network-based ranking, SMS+E-mail alerts, etc. But he also realizes that this involves a lot of money. Moreover, at 56, he lacks the know-how and capabilities to move in a whole new direction. There have been offers from the past to merge with fellow tutorials in the city, but then, he did not want to let go of a business he had so carefully nurtured over the years."

'Acme Learning' sees a clear opportunity in creating an umbrella brand and unifying these smaller players while helping them move to Ver 2.0. Their goal is to create a pan-India network bringing smaller players and mom-and-pops under the 'Acme Learning Network'.

Acme Learning Network offers the promise of a big brand combined with the trustworthiness of a local player. 'Shastri Tutorials' will now become 'Shasti Tutorials - A Acme Learning Network member'.

--

What will Prof.Shastri expect to gain from Acme in exchange for a small percentage of its revenues?

- Centralized product development.

Product know-how, high-quality study materials and tests in sync with the latest exam requirements that helps them compete with the larger players.

- Lower marketing/acquisition costs.

The power of a common brand signals uniform standards of quality to the market. Common pan-India marketing events aimed at brand-building and common admission drives lowering the average cost of acquisition for the members. Expensive media buys negotiated in bulk and common advertisements released bringing in huge cost savings. Exam Results ads and promotions leveraging the combined strength of the network.

- Regular teacher training.

New pedagogy and techniques. Improving teacher hiring practices. Remedial sessions over the internet. Certification systems. Reinforcement programmes. Intervention by top faculty members for specialized subjects/topics over VSAT/terrestrial internet.

- Up-to-date technology and support.

Right from centre management to student/parent communication systems and MIS. Online testing platforms. Mobile and Tablet apps integrated with course offerings. Centralized ranking for exams across the entire network (a huge plus for students in small towns). Digital classrooms.

In a single move, Shastri Tutorials gets a full makeover in terms of Brand, Product, Technology, Reach, Visibility, and Faculty. And Acme benefits from the entrepreneurial energy and experience of an existent, large tutor base. A win-win for both parties.

These are, but a few of the benefits that this model offers - the power of a large brand in terms of product, network and marketing; and at the same time the continued autonomy of managing a small business - a model of empowerment rather than that of a franchise. In a franchising system, the franchisor 'appoints' a potential partner - a teacher or in most cases, an entrepreneur looking for new opportunities - the churn rate is huge as there are capabilities mismatch or loss of interest in driving business. Customers are wary sometimes in joining franchisees (though many end up performing even better than company centres).

However, in the aforesaid model, the franchisor plays the part of an enabler who co-opts existing tutors/smaller players already operating in the space, consolidating them under one network and providing them resources that are crucial to their sustained success in a new market. In the eyes of the local market, this is the same Prof.Shastri who they have trusted all along offering a better product and service in a new avatar. He is not a stranger.

By building an organic network based on 85% of the test-prep market, a new 1000+ centres across India under a common brand looks like the big opportunity that could spurn the next wave of innovation and growth in a space, otherwise saturated by staid business models.

It's time to re-invent the test prep industry with the help of the neighbourhood tuition master.

RSS Feed

RSS Feed