Create a new ecosystem for education players.

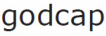

As of 2012, the global education market was worth USD 4.4 Trillion with the US alone constituting around 30%-roughly USD 1.4 Trillion - much larger than LinkedIn's addressable hiring market pegged at USD 27 billion (Source: LinkedIn via Forbes).

LinkedIn has been connecting job-seekers with companies. And now, it has the opportunity to connect learners with learning providers.

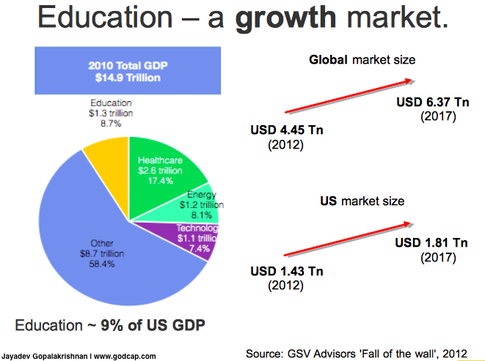

Increase traffic to the site by leveraging the huge growth in edu-search.

Education search has been on a growth not just in the US, but in other markets as well. In 2008, India was at the 8th position in education search on Google. By 2012, it had risen to the second place with the US retaining the top position.

Combined with new sign-ups coming from the 13 year + group for whom the doors have just been opened up, this will have a significant impact on its user-growth in the near term.

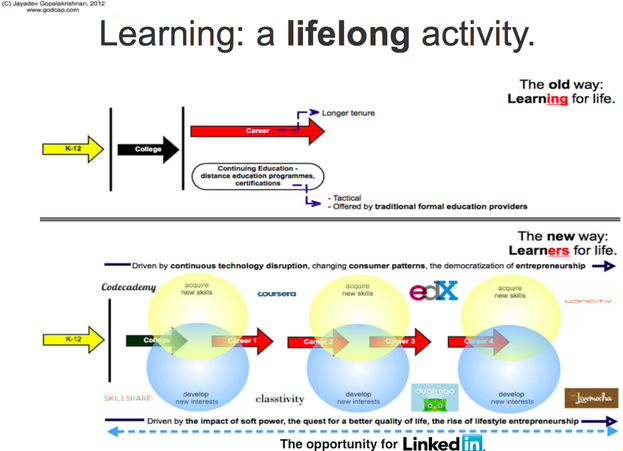

Ride the current wave of disruption in education.

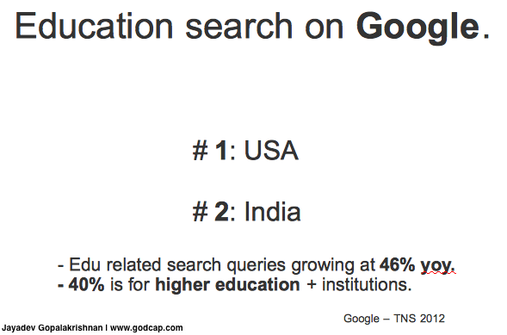

With the growing popularity of MOOCs and other online learning initiatives, education is at the crux of a potential disruption in delivery and consumption patterns. Online enrollment as a percentage of total Higher Education admissions in the US grew to over 6 million in 2012, around 32% of total enrollment, i.e. one in three college students takes at least one online course today. LinkedIn's new target group (13 years +) will be entering this segment in the next 5 years.

The other side of the coin.

For LinkedIn, the Education opportunity was in its backyard all the time. Giving users tools to discover the right learning providers, take relevant courses and connect with like-minded learners in order to achieve those career goals was a natural fit.

Also, by expanding the age-bracket for joining the site to 13 years, LinkedIn will acquire users young-at a stage where discussions around college begins-effectively ensuring that it becomes the brand that stays from college to career.

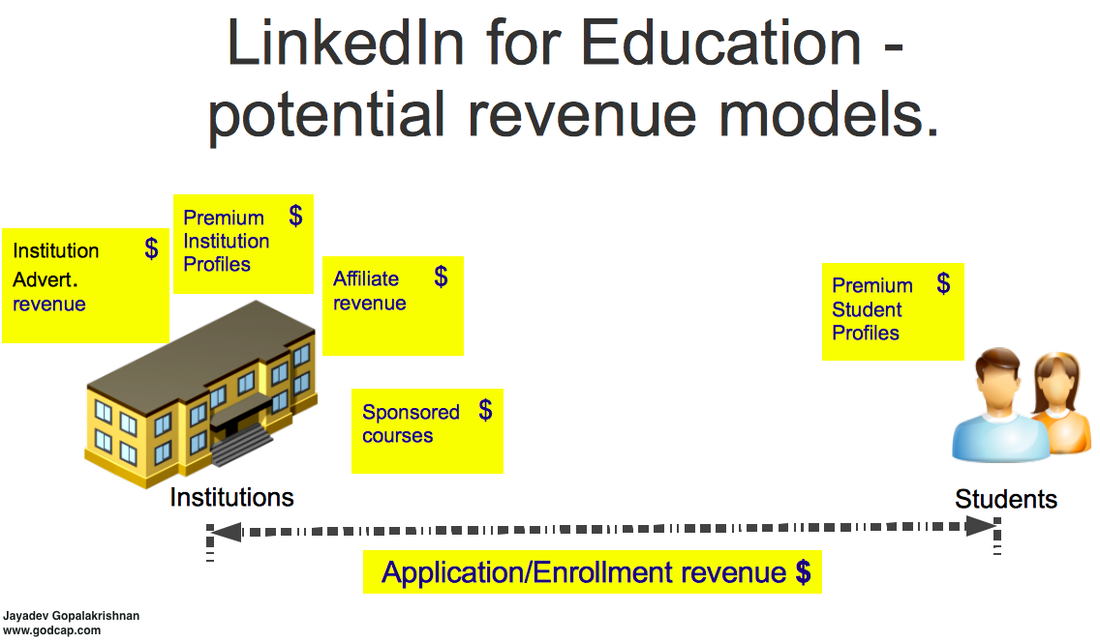

Create another powerful, yet diversified revenue portfolio.

Unlike Facebook which derives majority of its revenues from advertising, LinkedIn generates most of its money from Talent Solutions (>50%) and the balance split almost equally between marketing and premium profile solutions.

The nature of the platform and its structure lends the new education business to similar revenue models. I have made a few obvious postulations.

For instance, there are close to 4000 + Higher Education institutions in the US alone. Over 750,000 students use the Common App to submit over 3 million applications every year paying USD 60 on an average per application. As a USD 180 Mn dollar business opportunity, that might look chump change to LinkedIn. But when you expand that to multiple segments, multiple providers, multiple countries, the numbers are huge.

If LinkedIn can make applying to a University or just about any course as simple as applying for a job, that's a game changer.

Use data to create a Learning/Skills graph for the world.

The jury is still out on Facebook's Graph Search. But this could work very well for LinkedIn in the context of Education + Careers considering the strong linkage between the two.

LinkedIn has data on each of its 200 mn members - be it education, skills, certifications, and careers. Apart from having mined this data for creating a (sparingly-used) LinkedIn Skills page, imagine the possibilities of linking this data to education. By combining the Learner Graph (the graph of learners connected to each other) with the Learning Graph (the graph of courses that are connected to each other), LinkedIn will be able to predict learning patterns, emerging skill-sets and meaningful data that helps the world learn better for gainful employment.

A college student who uses LinkedIn search for "Courses required to become a Financial Analyst" should be able to get the right set of courses and a recommended career path as well.

Expect education to take a important two-digit percentage place within LinkedIn's financial reports in the next five years. Some news articles talked about how Facebook should have been the ideal platform for this market considering its history with campuses. But you are on Facebook for different reasons - take BranchOut's failure as a case in point. LinkedIn on the other hand is organically aligned to succeed with the education market.

Finally, success in Ed Tech is not just about the product. It's about having the right sales organization in place. Unless you have millions in the bank to feed feet-on-street, breaking into educational institutions is tough. In the larger context, LinkedIn's ability to succeed in this new market might lie in just the fact that they have a large sales team in place. The company's sales and marketing spend at 33% of revenues is already the highest in its category (Facebook ~15%). Also, quarter on quarter, its offline sales shadows online sales (Source: LinkedIn annual report). Selling into education would now become an additional task in the hands of an experienced sales team with additional products contributing to their portfolio and incentives.

The question is whether the company will be able to pull it off? Education as a play is different considering the socio-cultural issues around it, be it reducing costs (can they make some part of the value-chain less expensive?) or offering higher quality of information (can they ensure unbiased recommendations?).

If LinkedIn is able to position itself as a dependable brand for learners and educators offering relevant tools that address their needs meaningfully, the largest professional network could become the largest education network soon.

Last update: 16th September 2013.

RSS Feed

RSS Feed